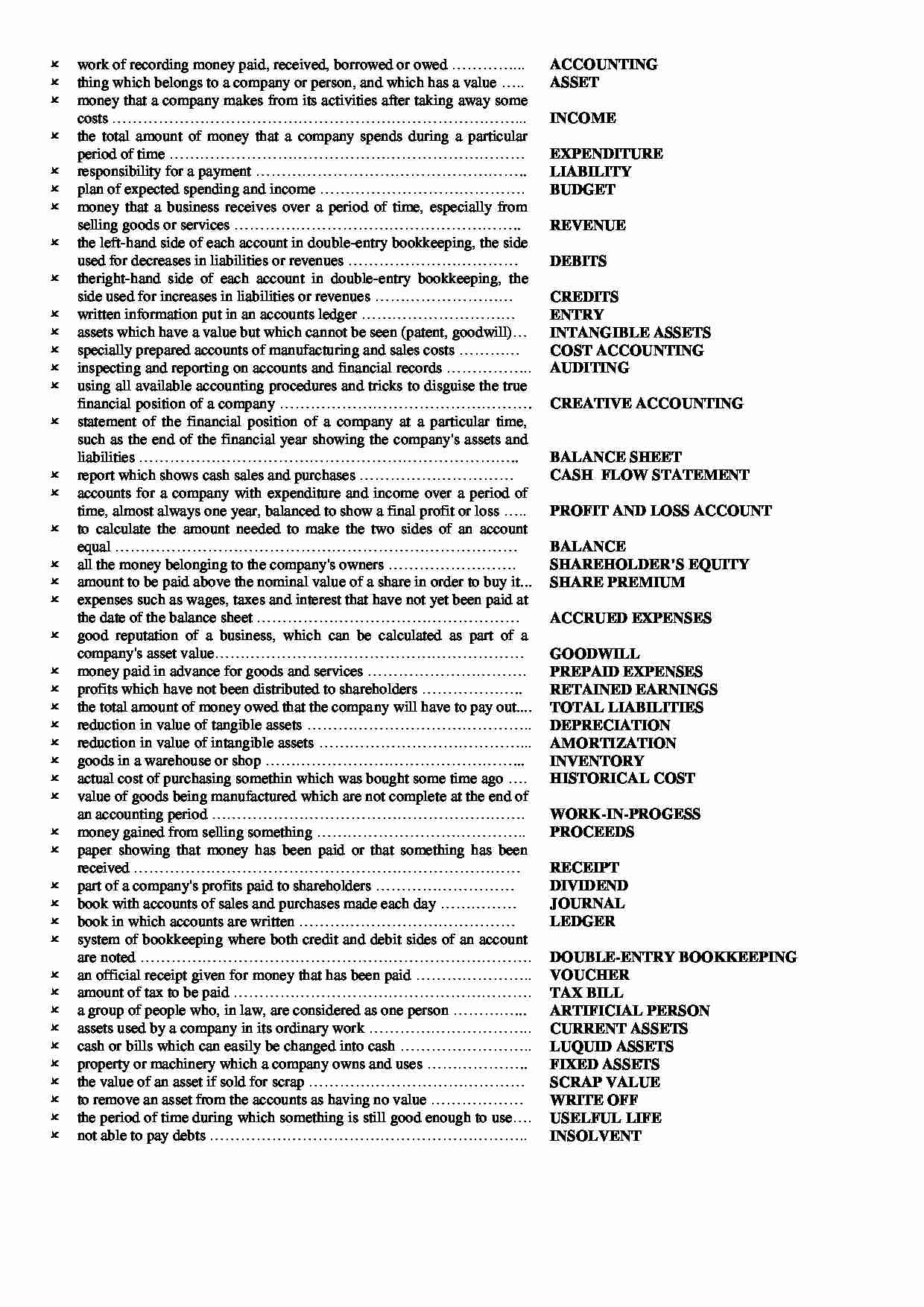

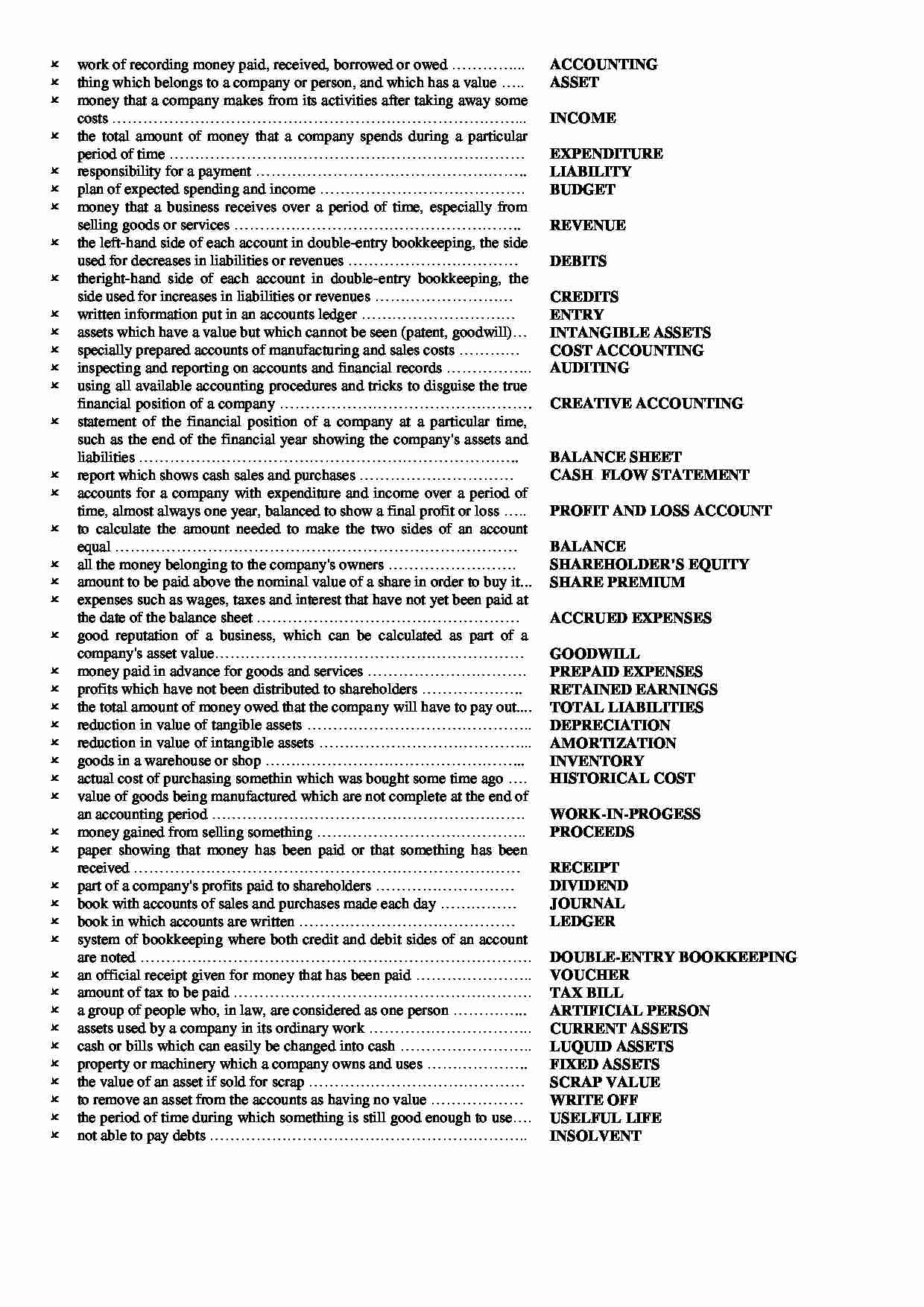

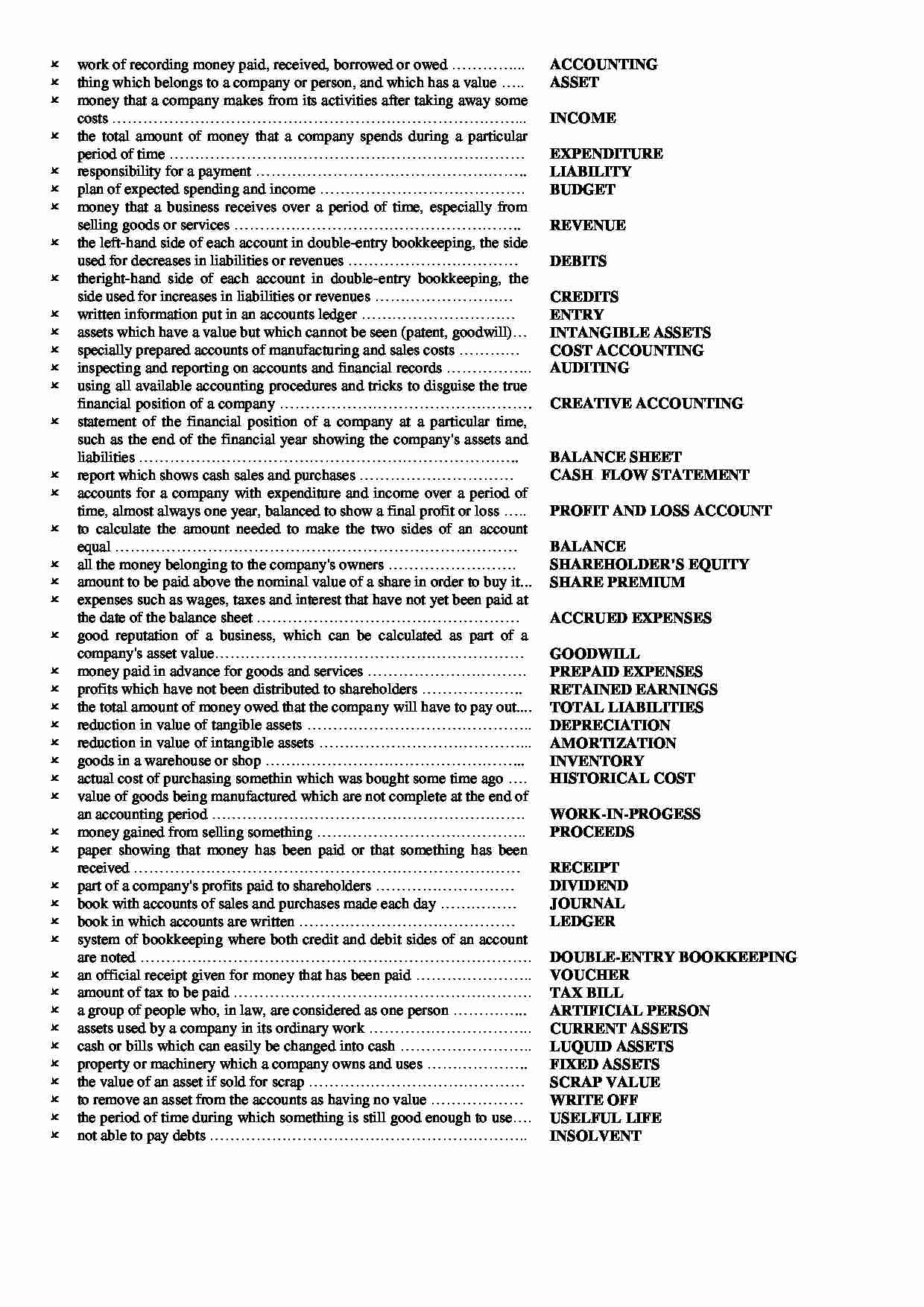

work of recording money paid, received, borrowed or owed …………... thing which belongs to a company or person, and which has a value ….. money that a company makes from its activities after taking away some costs ……………………………………………………………………... the total amount of money that a company spends during a particular period of time …………………………………………………………… responsibility for a payment …………………………………………….. plan of expected spending and income …………………………………. money that a business receives over a period of time, especially from selling goods or services ……………………………………………….. the left-hand side of each account in double-entry bookkeeping, the side used for decreases in liabilities or revenues …………………………… theright-hand side of each account in double-entry bookkeeping, the side used for increases in liabilities or revenues ……………………… written information put in an accounts ledger ………………………… assets which have a value but which cannot be seen (patent, goodwill)… specially prepared accounts of manufacturing and sales costs ………… inspecting and reporting on accounts and financial records …………….. using all available accounting procedures and tricks to disguise the true financial position of a company …………………………………………. statement of the financial position of a company at a particular time, such as the end of the financial year showing the company's assets and liabilities ……………………………………………………………….. report which shows cash sales and purchases ………………………… accounts for a company with expenditure and income over a period of time, almost always one year, balanced to show a final profit or loss ….. to calculate the amount needed to make the two sides of an account equal …………………………………………………………………… all the money belonging to the company's owners ……………………. amount to be paid above the nominal value of a share in order to buy it... expenses such as wages, taxes and interest that have not yet been paid at the date of the balance sheet ……………………………………………

... zobacz całą notatkę

Komentarze użytkowników (0)